http://monkbook.com/about/

Thelonious Monk: The Life and Times of An American Original by Robin Kelley--Free Press, October 2009

All,

The book is finally out and it is simply INCREDIBLE. This is an absolutely stupendous achievement by one of the finest social historians and cultural critics in this country, the great Robin D.G. Kelley. Dr. Kelley has written the definitive biography of the legendary Thelonious Monk and it is a 600 page masterpiece. Over ten years of exhaustive historical research and writing went into this opus and it was more than worth the wait! So don't hesitate for another second. GET THIS BOOK TODAY AND TELL EVERYONE YOU KNOW AND THEIR FRIENDS TO GO COP IT NOW...

(Note: I will be doing an extensive review and analysis of Dr. Kelley's new biography on this site as soon as I finish reading the text)

Kofi

http://monkbook.com/about/

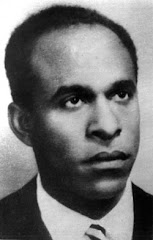

Who Is Thelonious Sphere Monk?

With the arrival Thelonious Sphere Monk, modern music—let alone modern culture—simply hasn’t been the same. Recognized as one of the most inventive pianists of any musical genre, Monk achieved a startlingly original sound that even his most devoted followers have been unable to successfully imitate. His musical vision was both ahead of its time and deeply rooted in tradition, spanning the entire history of the music from the “stride” masters of James P. Johnson and Willie “the Lion” Smith to the tonal freedom and kinetics of the “avant garde.” And he shares with Edward “Duke” Ellington the distinction of being one of the century’s greatest American composers. At the same time, his commitment to originality in all aspects of life—in fashion, in his creative use of language and economy of words, in his biting humor, even in the way he danced away from the piano—has led fans and detractors alike to call him “eccentric,” “mad” or even “taciturn.” Consequently, Monk has become perhaps the most talked about and least understood artist in the history of jazz.

Born on October 10, 1917, in Rocky Mount, North Carolina, Thelonious was only four when his mother Barbara, big sister Marion, and baby brother Thomas, moved to New York City. Unlike other Southern migrants who headed straight to Harlem, the Monks settled on West 63rd Street in the “San Juan Hill” neighborhood of Manhattan, near the Hudson River. His father, Thelonious, Sr., joined the family three years later, but health considerations forced him to return to North Carolina. During his stay, however, he often played the harmonica, “Jew’s harp,” and an old player piano the family acquired soon after he arrived. Thelonious’s mother also played piano, mostly hymns and other sacred music, and she encouraged her children’s musical interests by taking them to hear Franko Goldman’s band perform in nearby Central Park and paying for music lessons. She arranged piano lessons for Marion and hoped Thelonious would take up violin. He chose trumpet instead, and studied the instrument briefly but was challenged by bronchial issues. He was about eleven when Marion’s piano teacher took Thelonious on as a student. By his early teens, he was playing rent parties, sitting in on piano at a local Baptist church, and was reputed to have won several “amateur hour” competitions at the Apollo Theater.

Admitted to Peter Stuyvesant, one of the city’s best high schools, Monk dropped out at the end of his sophomore year to pursue music and during the summer of 1935 took a job as a pianist for a traveling evangelist and faith healer. Returning after two years, he formed his own quartet and played local bars and small clubs until the spring of 1941, when he became the house pianist at Minton’s Playhouse in Harlem.

Minton’s, legend has it, was where the “bebop revolution” began. The after-hours jam sessions at Minton’s, along with similar musical gatherings at Monroe’s Uptown House, Dan Wall’s Chili Shack, among others, attracted a new generation of musicians brimming with fresh ideas about harmony and rhythm—notably Charlie Parker, Dizzy Gillespie, Mary Lou Williams, Kenny Clarke, Oscar Pettiford, Max Roach, Tadd Dameron, and Monk’s close friend and fellow pianist, Bud Powell. Monk’s harmonic innovations proved fundamental to the development of modern jazz in this period. Anointed by some critics as the “High Priest of Bebop,” several of his compositions (“52nd Street Theme,” “‘Round Midnight,” “Epistrophy,” “I Mean You”) were favorites among his contemporaries.

Yet, as much as Monk helped usher in the bebop revolution, he also charted a new course for modern music few were willing to follow. Whereas most pianists of the bebop era played sparse chords in the left hand and emphasized fast, even eighth and sixteenth notes in the right hand, Monk combined an active right hand with an equally active left hand, fusing stride and angular rhythms that utilized the entire keyboard. And in an era when fast, dense, virtuosic solos were the order of the day, Monk was famous for his use of space and silence. In addition to his unique phrasing and economy of notes, Monk would “lay out” pretty regularly, enabling his sidemen to experiment free of the piano’s fixed pitches. As a composer, Monk was less interested in writing new melodic lines over popular chord progressions than in creating a whole new architecture for his music, one in which harmony and rhythm melded seamlessly with the melody. “Everything I play is different,” Monk once explained, “different melody, different harmony, different structure. Each piece is different from the other. … [W]hen the song tells a story, when it gets a certain sound, then it’s through…completed.”

Despite his contribution to the early development of modern jazz, Monk remained fairly marginal during the 1940s and early 1950s. Besides occasional gigs with bands led by Kenny Clarke, Lucky Millinder, Kermit Scott, and Skippy Williams, in 1944 tenor saxophonist Coleman Hawkins was the first to hire Monk for a lengthy engagement and the first to record with him. Most critics and many musicians were initially hostile to Monk’s sound. Blue Note, then a small record label, was the first to sign him to a contract. Thus, by the time he went into the studio to lead his first recording session in 1947, he was already thirty years old and a veteran of the jazz scene. Although all of Monk’s Blue Note sides are hailed today as some of his greatest recordings, at the time of their release in the late 1940s and early 1950s, they proved to be a commercial failure.

Harsh, ill-informed criticism limited Monk’s opportunities to work—opportunities he desperately needed especially after his marriage to Nellie Smith in 1948, and the birth of his son, Thelonious, Jr., in December of 1949. Monk found work where he could, but he never compromised his musical vision. His already precarious financial situation took a turn for the worse in August of 1951, when he was falsely arrested for narcotics possession, essentially taking the rap for his friend Bud Powell. It was his second arrest; the first, in 1948, was for possession of marijuana. Deprived of his cabaret card—a police-issued “license” without which jazz musicians could not perform in New York clubs—Monk was denied gigs in his home town for the next six years. Nevertheless, he played neighborhood clubs in Brooklyn, the Bronx, and Harlem, sporadic concerts, took out-of-town gigs, composed new music, and made several trio and ensemble records under the Prestige label (1952–1954), which included memorable performances with Sonny Rollins, Miles Davis, and Milt Jackson. In the fall of1953, he celebrated the birth of his daughter Barbara, and the following summer he crossed the Atlantic for the first time to play the Paris Jazz Festival. During his stay, he recorded his first solo album for Vogue. These recordings would begin to establish Monk as one of the century’s most imaginative solo pianists.

In 1955, Monk signed with a new label, Riverside, and recorded several outstanding LP’s which garnered critical attention, notably Thelonious Monk Plays Duke Ellington, The Unique Thelonious Monk, Brilliant Corners, Monk’s Music and his second solo album, Thelonious Himself. In 1957, with the help of his friend and sometime patron, the Baroness Pannonica de Koenigswarter, he had finally gotten his cabaret card restored and enjoyed a very long and successful engagement at the Five Spot Café with John Coltrane on tenor saxophone, Wilbur Ware and later Ahmed Abdul-Malik on bass, and Shadow Wilson on drums. From that point on, his career began to soar; his collaborations with Johnny Griffin, Sonny Rollins, Art Blakey, Clark Terry, Gerry Mulligan, and arranger Hall Overton, among others, were lauded by critics and studied by conservatory students. Monk even led a successful big band at Town Hall in 1959. It was as if jazz audiences had finally caught up to Monk’s music.

By 1961, Monk had established a more or less permanent quartet consisting of Charlie Rouse on tenor saxophone, John Ore (later Butch Warren and then Larry Gales) on bass, and Frankie Dunlop (later Ben Riley) on drums. He performed with his own big band at Lincoln Center (1963), and the quartet made a few European and world tours throughout the decade. In 1962, Monk had also signed with the gargantuan Columbia records, and in February of 1964 he became the third jazz musician in history to grace the cover of Time Magazine.

However, with fame came the media’s growing fascination with Monk’s alleged eccentricities. Stories of his behavior on and off the bandstand often overshadowed serious commentary about his music. The media helped invent the mythical Monk—the reclusive, naïve, idiot savant whose musical ideas were supposed to be entirely intuitive rather than the product of intensive study, knowledge and practice. Indeed, his reputation as a recluse (Time called him the “loneliest Monk”) reveals just how much Monk had been misunderstood. As his former sideman, tenor saxophonist Johnny Griffin, explained, Monk was somewhat of a homebody: “If Monk isn’t working he isn’t on the scene. Monk stays home. He goes away and rests.” Unlike the popular stereotypes of the jazz musician, Monk was devoted to his family. He appeared at family events, played birthday parties, and wrote playfully complex songs for his children: “Little Rootie Tootie” for his son, “Boo Boo’s Birthday” and “Green Chimneys” for his daughter, and a Christmas song titled “A Merrier Christmas.” The fact is, the Monk family held together despite long stretches without work, severe money shortages, sustained attacks by critics, grueling road trips, bouts with illness, and the loss of close friends.

During the 1960s, Monk scored notable successes with albums such as Criss Cross, Monk’s Dream, It’s Monk Time, Straight No Chaser, and Underground. But as Columbia/CBS records pursued a younger, rock-oriented audience, Monk and other jazz musicians ceased to be a priority for the label. Monk’s final recording with Columbia was a big band session with Oliver Nelson’s Orchestra in November of 1968, which turned out to be both an artistic and commercial failure. Columbia’s disinterest and Monk’s deteriorating health kept the pianist out of the studio. In January of 1970, Charlie Rouse left the band, and two years later Columbia quietly dropped Monk from its roster. For the next few years, Monk accepted fewer engagements and recorded even less. His quartet featured saxophonists Pat Patrick and Paul Jeffrey, and his son Thelonious, Jr., took over on drums in 1971. That same year and again in 1972, Monk toured widely with the “Giants of Jazz,” a kind of bop revival group consisting of Dizzy Gillespie, Kai Winding, Sonny Stitt, Al McKibbon and Art Blakey, and made his final public appearance in July of 1976. Physical illness, fatigue, and perhaps sheer creative exhaustion convinced Monk to give up playing altogether. On February 5, 1982, he suffered a stroke and never regained consciousness; twelve days later, on February 17th, he died.

Today Thelonious Monk is widely accepted as a genuine master of American music. His compositions constitute the core of jazz repertory and are performed by artists from many different genres. He is the subject of award winning documentaries, biographies and scholarly studies, prime time television tributes, and he even has an Institute created in his name. The Thelonious Monk Institute was created to promote jazz education and to train and encourage new generations of musicians. It is a fitting tribute to an artist who was always willing to share his musical knowledge with others but expected originality in return.

Book Events

Monday, October 5, 2009, 7:00 – 9:00 PM

Barnes and Noble

66th and Broadway

New York, NY

212-595-6859

Thursday, October 8, 2009, 7:30

Book party, Discussion, and Jam session

The Brecht Forum

451 West Street, New York, NY 10014 (between Bank & Bethune Streets)

Phone: (212) 242-4201 – Email: brechtforum at brechtforum.org

Saturday, October 10, 2009, 6:00 – 8:00 PM

Politics and Prose Bookstore and Coffee House

5015 Connecticut Ave., NW

Washington, DC

http://www.politics-prose.com

Tuesday, October 13, 2009, 7:30 PM

Conversation with Robin D. G. Kelley on Thelonious Monk

With Guest, pianist Randy Weston

Center for Jazz Studies, Columbia University

Dwyer Cultural Center, 258 St. Nicholas Ave. and 123rd St.

New York

Thursday, October 15, 2009, 3:00 PM

Reading and book signing, “‘North of the Sunset’: Thelonious Monk’s L.A. Stories”

Charles E. Young Research Library, UCLA

Presentation Room

Los Angeles, CA

Free and open to the public

Tuesday, October 20, 2009, 7:00 PM

Book Soup

8818 W Sunset Blvd

Los Angeles, CA 90069-2125

(310) 659-3110

http://www.booksoup.com/

October 23, 2009, 7:00 PM

Vroman’s Bookstore

695 E Colorado Blvd

Pasadena, CA 91101

(626) 449-5320

http://www.vromansbookstore.com/

October 27, 1009, 7:00 PM

Eso Won Bookstore

4311 Degnan Blvd.

Los Angeles, CA 90008

(323) 290-1048

info@esowonbookstore.com

http://www.esowonbookstore.com/

October 29, 2009, 7:00 PM

City Lights Bookstore

261 Columbus Avenue at Broadway (North Beach)

San Francisco, California 94133

Tel (415) 362-8193

http://www.citylights.com

Return to Main Menu.

With the arrival Thelonious Sphere Monk, modern music—let alone modern culture—simply hasn’t been the same. Recognized as one of the most inventive pianists of any musical genre, Monk achieved a startlingly original sound that even his most devoted followers have been unable to successfully imitate. His musical vision was both ahead of its time and deeply rooted in tradition, spanning the entire history of the music from the “stride” masters of James P. Johnson and Willie “the Lion” Smith to the tonal freedom and kinetics of the “avant garde.” And he shares with Edward “Duke” Ellington the distinction of being one of the century’s greatest American composers. At the same time, his commitment to originality in all aspects of life—in fashion, in his creative use of language and economy of words, in his biting humor, even in the way he danced away from the piano—has led fans and detractors alike to call him “eccentric,” “mad” or even “taciturn.” Consequently, Monk has become perhaps the most talked about and least understood artist in the history of jazz.

Born on October 10, 1917, in Rocky Mount, North Carolina, Thelonious was only four when his mother Barbara, big sister Marion, and baby brother Thomas, moved to New York City. Unlike other Southern migrants who headed straight to Harlem, the Monks settled on West 63rd Street in the “San Juan Hill” neighborhood of Manhattan, near the Hudson River. His father, Thelonious, Sr., joined the family three years later, but health considerations forced him to return to North Carolina. During his stay, however, he often played the harmonica, “Jew’s harp,” and an old player piano the family acquired soon after he arrived. Thelonious’s mother also played piano, mostly hymns and other sacred music, and she encouraged her children’s musical interests by taking them to hear Franko Goldman’s band perform in nearby Central Park and paying for music lessons. She arranged piano lessons for Marion and hoped Thelonious would take up violin. He chose trumpet instead, and studied the instrument briefly but was challenged by bronchial issues. He was about eleven when Marion’s piano teacher took Thelonious on as a student. By his early teens, he was playing rent parties, sitting in on piano at a local Baptist church, and was reputed to have won several “amateur hour” competitions at the Apollo Theater.

Admitted to Peter Stuyvesant, one of the city’s best high schools, Monk dropped out at the end of his sophomore year to pursue music and during the summer of 1935 took a job as a pianist for a traveling evangelist and faith healer. Returning after two years, he formed his own quartet and played local bars and small clubs until the spring of 1941, when he became the house pianist at Minton’s Playhouse in Harlem.

Minton’s, legend has it, was where the “bebop revolution” began. The after-hours jam sessions at Minton’s, along with similar musical gatherings at Monroe’s Uptown House, Dan Wall’s Chili Shack, among others, attracted a new generation of musicians brimming with fresh ideas about harmony and rhythm—notably Charlie Parker, Dizzy Gillespie, Mary Lou Williams, Kenny Clarke, Oscar Pettiford, Max Roach, Tadd Dameron, and Monk’s close friend and fellow pianist, Bud Powell. Monk’s harmonic innovations proved fundamental to the development of modern jazz in this period. Anointed by some critics as the “High Priest of Bebop,” several of his compositions (“52nd Street Theme,” “‘Round Midnight,” “Epistrophy,” “I Mean You”) were favorites among his contemporaries.

Yet, as much as Monk helped usher in the bebop revolution, he also charted a new course for modern music few were willing to follow. Whereas most pianists of the bebop era played sparse chords in the left hand and emphasized fast, even eighth and sixteenth notes in the right hand, Monk combined an active right hand with an equally active left hand, fusing stride and angular rhythms that utilized the entire keyboard. And in an era when fast, dense, virtuosic solos were the order of the day, Monk was famous for his use of space and silence. In addition to his unique phrasing and economy of notes, Monk would “lay out” pretty regularly, enabling his sidemen to experiment free of the piano’s fixed pitches. As a composer, Monk was less interested in writing new melodic lines over popular chord progressions than in creating a whole new architecture for his music, one in which harmony and rhythm melded seamlessly with the melody. “Everything I play is different,” Monk once explained, “different melody, different harmony, different structure. Each piece is different from the other. … [W]hen the song tells a story, when it gets a certain sound, then it’s through…completed.”

Despite his contribution to the early development of modern jazz, Monk remained fairly marginal during the 1940s and early 1950s. Besides occasional gigs with bands led by Kenny Clarke, Lucky Millinder, Kermit Scott, and Skippy Williams, in 1944 tenor saxophonist Coleman Hawkins was the first to hire Monk for a lengthy engagement and the first to record with him. Most critics and many musicians were initially hostile to Monk’s sound. Blue Note, then a small record label, was the first to sign him to a contract. Thus, by the time he went into the studio to lead his first recording session in 1947, he was already thirty years old and a veteran of the jazz scene. Although all of Monk’s Blue Note sides are hailed today as some of his greatest recordings, at the time of their release in the late 1940s and early 1950s, they proved to be a commercial failure.

Harsh, ill-informed criticism limited Monk’s opportunities to work—opportunities he desperately needed especially after his marriage to Nellie Smith in 1948, and the birth of his son, Thelonious, Jr., in December of 1949. Monk found work where he could, but he never compromised his musical vision. His already precarious financial situation took a turn for the worse in August of 1951, when he was falsely arrested for narcotics possession, essentially taking the rap for his friend Bud Powell. It was his second arrest; the first, in 1948, was for possession of marijuana. Deprived of his cabaret card—a police-issued “license” without which jazz musicians could not perform in New York clubs—Monk was denied gigs in his home town for the next six years. Nevertheless, he played neighborhood clubs in Brooklyn, the Bronx, and Harlem, sporadic concerts, took out-of-town gigs, composed new music, and made several trio and ensemble records under the Prestige label (1952–1954), which included memorable performances with Sonny Rollins, Miles Davis, and Milt Jackson. In the fall of1953, he celebrated the birth of his daughter Barbara, and the following summer he crossed the Atlantic for the first time to play the Paris Jazz Festival. During his stay, he recorded his first solo album for Vogue. These recordings would begin to establish Monk as one of the century’s most imaginative solo pianists.

In 1955, Monk signed with a new label, Riverside, and recorded several outstanding LP’s which garnered critical attention, notably Thelonious Monk Plays Duke Ellington, The Unique Thelonious Monk, Brilliant Corners, Monk’s Music and his second solo album, Thelonious Himself. In 1957, with the help of his friend and sometime patron, the Baroness Pannonica de Koenigswarter, he had finally gotten his cabaret card restored and enjoyed a very long and successful engagement at the Five Spot Café with John Coltrane on tenor saxophone, Wilbur Ware and later Ahmed Abdul-Malik on bass, and Shadow Wilson on drums. From that point on, his career began to soar; his collaborations with Johnny Griffin, Sonny Rollins, Art Blakey, Clark Terry, Gerry Mulligan, and arranger Hall Overton, among others, were lauded by critics and studied by conservatory students. Monk even led a successful big band at Town Hall in 1959. It was as if jazz audiences had finally caught up to Monk’s music.

By 1961, Monk had established a more or less permanent quartet consisting of Charlie Rouse on tenor saxophone, John Ore (later Butch Warren and then Larry Gales) on bass, and Frankie Dunlop (later Ben Riley) on drums. He performed with his own big band at Lincoln Center (1963), and the quartet made a few European and world tours throughout the decade. In 1962, Monk had also signed with the gargantuan Columbia records, and in February of 1964 he became the third jazz musician in history to grace the cover of Time Magazine.

However, with fame came the media’s growing fascination with Monk’s alleged eccentricities. Stories of his behavior on and off the bandstand often overshadowed serious commentary about his music. The media helped invent the mythical Monk—the reclusive, naïve, idiot savant whose musical ideas were supposed to be entirely intuitive rather than the product of intensive study, knowledge and practice. Indeed, his reputation as a recluse (Time called him the “loneliest Monk”) reveals just how much Monk had been misunderstood. As his former sideman, tenor saxophonist Johnny Griffin, explained, Monk was somewhat of a homebody: “If Monk isn’t working he isn’t on the scene. Monk stays home. He goes away and rests.” Unlike the popular stereotypes of the jazz musician, Monk was devoted to his family. He appeared at family events, played birthday parties, and wrote playfully complex songs for his children: “Little Rootie Tootie” for his son, “Boo Boo’s Birthday” and “Green Chimneys” for his daughter, and a Christmas song titled “A Merrier Christmas.” The fact is, the Monk family held together despite long stretches without work, severe money shortages, sustained attacks by critics, grueling road trips, bouts with illness, and the loss of close friends.

During the 1960s, Monk scored notable successes with albums such as Criss Cross, Monk’s Dream, It’s Monk Time, Straight No Chaser, and Underground. But as Columbia/CBS records pursued a younger, rock-oriented audience, Monk and other jazz musicians ceased to be a priority for the label. Monk’s final recording with Columbia was a big band session with Oliver Nelson’s Orchestra in November of 1968, which turned out to be both an artistic and commercial failure. Columbia’s disinterest and Monk’s deteriorating health kept the pianist out of the studio. In January of 1970, Charlie Rouse left the band, and two years later Columbia quietly dropped Monk from its roster. For the next few years, Monk accepted fewer engagements and recorded even less. His quartet featured saxophonists Pat Patrick and Paul Jeffrey, and his son Thelonious, Jr., took over on drums in 1971. That same year and again in 1972, Monk toured widely with the “Giants of Jazz,” a kind of bop revival group consisting of Dizzy Gillespie, Kai Winding, Sonny Stitt, Al McKibbon and Art Blakey, and made his final public appearance in July of 1976. Physical illness, fatigue, and perhaps sheer creative exhaustion convinced Monk to give up playing altogether. On February 5, 1982, he suffered a stroke and never regained consciousness; twelve days later, on February 17th, he died.

Today Thelonious Monk is widely accepted as a genuine master of American music. His compositions constitute the core of jazz repertory and are performed by artists from many different genres. He is the subject of award winning documentaries, biographies and scholarly studies, prime time television tributes, and he even has an Institute created in his name. The Thelonious Monk Institute was created to promote jazz education and to train and encourage new generations of musicians. It is a fitting tribute to an artist who was always willing to share his musical knowledge with others but expected originality in return.

Book Events

Monday, October 5, 2009, 7:00 – 9:00 PM

Barnes and Noble

66th and Broadway

New York, NY

212-595-6859

Thursday, October 8, 2009, 7:30

Book party, Discussion, and Jam session

The Brecht Forum

451 West Street, New York, NY 10014 (between Bank & Bethune Streets)

Phone: (212) 242-4201 – Email: brechtforum at brechtforum.org

Saturday, October 10, 2009, 6:00 – 8:00 PM

Politics and Prose Bookstore and Coffee House

5015 Connecticut Ave., NW

Washington, DC

http://www.politics-prose.com

Tuesday, October 13, 2009, 7:30 PM

Conversation with Robin D. G. Kelley on Thelonious Monk

With Guest, pianist Randy Weston

Center for Jazz Studies, Columbia University

Dwyer Cultural Center, 258 St. Nicholas Ave. and 123rd St.

New York

Thursday, October 15, 2009, 3:00 PM

Reading and book signing, “‘North of the Sunset’: Thelonious Monk’s L.A. Stories”

Charles E. Young Research Library, UCLA

Presentation Room

Los Angeles, CA

Free and open to the public

Tuesday, October 20, 2009, 7:00 PM

Book Soup

8818 W Sunset Blvd

Los Angeles, CA 90069-2125

(310) 659-3110

http://www.booksoup.com/

October 23, 2009, 7:00 PM

Vroman’s Bookstore

695 E Colorado Blvd

Pasadena, CA 91101

(626) 449-5320

http://www.vromansbookstore.com/

October 27, 1009, 7:00 PM

Eso Won Bookstore

4311 Degnan Blvd.

Los Angeles, CA 90008

(323) 290-1048

info@esowonbookstore.com

http://www.esowonbookstore.com/

October 29, 2009, 7:00 PM

City Lights Bookstore

261 Columbus Avenue at Broadway (North Beach)

San Francisco, California 94133

Tel (415) 362-8193

http://www.citylights.com

Return to Main Menu.

Home

The Book

About The Author

Reviews

Sessionography

Who Is Thelonious Sphere Monk?

Photos

Videos

Book Events

Links

Contact

The Book

Thelonious Monk: The Life and Times of an American Original

“The piano ain’t got no wrong notes!” So ranted Thelonious Sphere Monk, who proved his point every time he sat down at the keyboard. His angular melodies and dissonant harmonies shook the jazz world to its foundations, ushering in the birth of “bebop” and establishing Monk as one of America’s greatest composers. Yet throughout much of his life, his musical contribution took a backseat to tales of his reputed behavior. Writers tended to obsess over Monk’s hats or his proclivity to dance on stage. To his fans, he was the ultimate hipster; to his detractors he was temperamental, eccentric, taciturn, or child-like. But, these labels tell us little about the man or his music.

In the first book on Thelonious Monk based on exclusive access to the Monk family papers and private recordings, as well as a decade of prodigious research, prize-winning historian Robin D. G. Kelley brings to light a startlingly different Thelonious Monk–witty, intelligent, generous, family-oriented, politically engaged, brutally honest, and a devoted father and husband. Indeed, Thelonious Monk is essentially a love story. It is a story of familial love, beginning with Monk’s enslaved descendants from whom Thelonious inherited an appreciation for community, freedom, and black traditions of sacred and secular song. It is about a doting mother who scrubbed floors to pay for piano lessons and encouraged her son to follow his dream. It is the story of romance, from Monk’s initial heartbreaks to his life-long commitment to his muse, the extraordinary Nellie Monk. And it is about his unique friendship with the Baroness Nica de Koenigswarter, a scion of the famous Rothschild family whose relationship with Monk and other jazz musicians has long been the subject of speculation and rumor. Nellie, Nica, and various friends and family sustained Monk during the long periods of joblessness, bipolar episodes, incarceration, health crises, and other tragic and difficult moments.

Above all, Thelonious Monk is the gripping saga of an artist’s struggle to “make it” without compromising his musical vision. It is a story that, like its subject, reflects the tidal ebbs and flows of American history in the twentieth century. Elegantly written and rich with humor and pathos, Thelonious Monk is the definitive work on modern jazz’s most original composer.

Advance Praise for Thelonious Monk: The Life and Times of an American Original

“Robin Kelley’s new biography Thelonious Monk: The Life And Times of an American Original is a breath of fresh air amongst the biographies of our legendary jazz musicians. This book is thorough, detailed and written with a true affinity for Monk’s humaneness and creative musical output. It fills in the missing pieces about the growth of the jazz scene in New York through the ’40s, ’50s and ’60s, detailing each step of TSM’s development – who passed through his bands, what gigs he played and what happened on those scenes. It’s an invaluable and close look at the center of the world’s most important creative musical developments in these decades: New York City.”

—Chick Corea

“Thelonious Monk: The Life And Times of an American Original is one of the most anticipated books in jazz scholarship, and well worth the wait. Robin D. G. Kelley represents one of this generation’s most important voices equipped with the knowledge, passion and respect for both jazz and jazz musicians required to interpret the many details and nuances of Thelonious Monk’s life. This compelling book will both challenge old assumptions and inspire new assessments of the life and legacy one of the world’s greatest musicians.”

—Geri Allen, pianist/composer, Associate Professor of Jazz & Contemporary Improvisation, University Of Michigan

“Powerful, enraging and enduring. . . . In Robin Kelley’s finely grained and surely definitive life-and-times study, Thelonious Monk: The Life And Times of an American Original, has found an original biographer.”

—David Levering Lewis, biographer of W.E.B. Du Bois and Pulitzer Prize winner

“An honest and eloquent treatment of one of our most important artists, Thelonious Monk: The Life And Times of an American Original is a stunning tour de force! It is the most comprehensive treatment of Monk’s life to date. Furthermore, in Monk’s story, Kelley has found the perfect medium to shed light on a nation’s, and a people’s, history and persistent quest for freedom. In so doing he has given us a book that is as bold, brilliant and beautiful as Monk and his music.”

—Farah Jasmine Griffin, author of If You Can’t Be Free, Be a Mystery: In Search of Billie Holiday

About The Author

Robin D. G. Kelley never met Thelonious Monk, but he grew up with his music. Born in 1962, he spent his formative years in Harlem in a household and a city saturated with modern jazz. As a child he took a few trumpet lessons with the legendary Jimmy Owens, played French horn in junior high school, and picked up piano during his teen years in California. In 1987, Kelley earned his PhD in History from UCLA and focused his work on social movements, politics and culture—although music remained his passion.

During his tenure on the faculties of Emory University, the University of Michigan, New York University, and Columbia University, Kelley’s scholarly interests shifted increasingly toward music. He has written widely on jazz, hip hop, electronic music, musicians’ unions and technological displacement, and social and political movements more broadly.

Before becoming Professor of American Studies and Ethnicity at the University of Southern California, Robin D. G. Kelley served on the faculty at Columbia University’s Center for Jazz Studies, where he held the first Louis Armstrong Chair in Jazz Studies. Besides Thelonious Monk: The Life and Times of an American Original, Kelley has authored several prize-winning books, including Hammer and Hoe: Alabama Communists During the Great Depression (University of North Carolina Press, 1990); Race Rebels: Culture Politics and the Black Working Class (The Free Press, 1994); Yo’ Mama’s DisFunktional!: Fighting the Culture Wars in Urban America (Beacon Press, 1997), which was selected one of the top ten books of 1998 by the Village Voice; Three Strikes: Miners, Musicians, Salesgirls, and the Fighting Spirit of Labor’s Last Century, written collaboratively with Dana Frank and Howard Zinn (Beacon 2001); and Freedom Dreams: The Black Radical Imagination (Beacon Press, 2002). He also edited (with Earl Lewis), To Make Our World Anew: A History of African Americans (Oxford University Press, 2000), a Choice Outstanding Academic Title and a History Book Club Selection. Kelley also co-edited (with Sidney J. Lemelle) Imagining Home: Class, Culture, and Nationalism in the African Diaspora (Verso, 1994). He is currently completing Speaking in Tongues: Jazz and Modern Africa (Harvard University Press, forthcoming), and a general survey of African American history co-authored with Tera Hunter and Earl Lewis to be published by Norton.

Kelley’s essays have appeared in several anthologies and journals, including The Nation, Monthly Review, The Voice Literary Supplement, New York Times (Arts and Leisure), New York Times Magazine, Rolling Stone, Color Lines, Code Magazine, Utne Reader, Lenox Avenue, African Studies Review, Black Music Research Journal, Callaloo, New Politics, Black Renaissance/Renaissance Noir, One World, Social Text, Metropolis, American Visions, Boston Review, Fashion Theory, American Historical Review, Journal of American History, New Labor Forum, Souls, Metropolis, and frieze: contemporary art and culture, to name a few.

Video of Robin Kelley author of new biography Thelonious Monk: The Life & Times of An American Original talking about Monk and his book:

http://www.simonandschuster.com/multimedia?video=44534277001