http://www.nytimes.com/2009/10/20/opinion/20herbert.html?em=&adxnnl=1&adxnnlx=1256130717-L8tuy0dm4G166hjC8/EUUA

October 20, 2009

OP-ED COLUMNIST

Safety Nets for the Rich

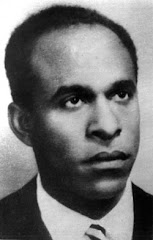

By Bob Herbert

New York Times

The headlines that ran side by side on the front page of Saturday’s New York Times summed up, inadvertently, the terrible fix that we’ve allowed our country to fall into.

The lead headline, in the upper right-hand corner, said: “U.S. Deficit Rises to $1.4 Trillion; Biggest Since ’45.”

The headline next to it said: “Bailout Helps Revive Banks, And Bonuses.”

We’ve spent the last few decades shoveling money at the rich like there was no tomorrow. We abandoned the poor, put an economic stranglehold on the middle class and all but bankrupted the federal government — while giving the banks and megacorporations and the rest of the swells at the top of the economic pyramid just about everything they’ve wanted.

And we still don’t seem to have learned the proper lessons. We’ve allowed so many people to fall into the terrible abyss of unemployment that no one — not the Obama administration, not the labor unions and most certainly no one in the Republican Party — has a clue about how to put them back to work.

Meanwhile, Wall Street is living it up. I’m amazed at how passive the population has remained in the face of this sustained outrage.

Even as tens of millions of working Americans are struggling to hang onto their jobs and keep a roof over their families’ heads, the wise guys of Wall Street are licking their fat-cat chops over yet another round of obscene multibillion-dollar bonuses — this time thanks to the bailout billions that were sent their way by Uncle Sam, with very little in the way of strings attached.

Nevermind that the economy remains deeply troubled. As The Times pointed out on Saturday, much of Wall Street “is minting money.”

Call it déjà voodoo. I wrote a column that ran three days before Christmas in 2007 that focused on the deeply disturbing disconnect between Wall Streeters harvesting a record crop of bonuses — billions on top of billions — while working families were having a very hard time making ends meet.

We would later learn that December 2007 was the very month that the Great Recession began. I wrote in that column: “Even as the Wall Streeters are high-fiving and ordering up record shipments of Champagne and caviar, the American dream is on life support.”

So we had an orgy of bonuses just as the recession was taking hold and now another orgy (with taxpayers as the enablers) that is nothing short of an arrogantly pointed finger in the eye of everyone who suffered, and continues to suffer, in this downturn.

Whether P.T. Barnum actually said it or not, there is a sucker born every minute. American taxpayers might want to take a look in the mirror. If the epithet fits...

We need to make some fundamental changes in the way we do things in this country. The gamblers and con artists of the financial sector, the very same clowns who did so much to bring the economy down in the first place, are howling self-righteously over the prospect of regulations aimed at curbing the worst aspects of their excessively risky behavior and preventing them from causing yet another economic meltdown.

We should be going even further. We’ve institutionalized the idea that there are firms that are too big to fail and, therefore, “we, the people” are obliged to see that they don’t — even if that means bankrupting the national treasury and undermining the living standards of ordinary people. What sense does that make?

If some company is too big to fail, then it’s too big to exist. Break it up.

Why should the general public have to constantly worry that a misstep by the high-wire artists at Goldman Sachs (to take the most obvious example) would put the entire economy in peril? These financial acrobats get the extraordinary benefits of their outlandish risk-taking — multimillion-dollar paychecks, homes the size of castles — but the public has to be there to absorb the worst of the pain when they take a terrible fall.

Enough! Goldman Sachs is thriving while the combined rates of unemployment and underemployment are creeping toward a mind-boggling 20 percent. Two-thirds of all the income gains from the years 2002 to 2007 — two-thirds! — went to the top 1 percent of Americans.

We cannot continue transferring the nation’s wealth to those at the apex of the economic pyramid — which is what we have been doing for the past three decades or so — while hoping that someday, maybe, the benefits of that transfer will trickle down in the form of steady employment and improved living standards for the many millions of families struggling to make it from day to day.

That money is never going to trickle down. It’s a fairy tale. We’re crazy to continue believing it.

Copyright 2009 The New York Times Company

October 20, 2009

OP-ED COLUMNIST

Safety Nets for the Rich

By Bob Herbert

New York Times

The headlines that ran side by side on the front page of Saturday’s New York Times summed up, inadvertently, the terrible fix that we’ve allowed our country to fall into.

The lead headline, in the upper right-hand corner, said: “U.S. Deficit Rises to $1.4 Trillion; Biggest Since ’45.”

The headline next to it said: “Bailout Helps Revive Banks, And Bonuses.”

We’ve spent the last few decades shoveling money at the rich like there was no tomorrow. We abandoned the poor, put an economic stranglehold on the middle class and all but bankrupted the federal government — while giving the banks and megacorporations and the rest of the swells at the top of the economic pyramid just about everything they’ve wanted.

And we still don’t seem to have learned the proper lessons. We’ve allowed so many people to fall into the terrible abyss of unemployment that no one — not the Obama administration, not the labor unions and most certainly no one in the Republican Party — has a clue about how to put them back to work.

Meanwhile, Wall Street is living it up. I’m amazed at how passive the population has remained in the face of this sustained outrage.

Even as tens of millions of working Americans are struggling to hang onto their jobs and keep a roof over their families’ heads, the wise guys of Wall Street are licking their fat-cat chops over yet another round of obscene multibillion-dollar bonuses — this time thanks to the bailout billions that were sent their way by Uncle Sam, with very little in the way of strings attached.

Nevermind that the economy remains deeply troubled. As The Times pointed out on Saturday, much of Wall Street “is minting money.”

Call it déjà voodoo. I wrote a column that ran three days before Christmas in 2007 that focused on the deeply disturbing disconnect between Wall Streeters harvesting a record crop of bonuses — billions on top of billions — while working families were having a very hard time making ends meet.

We would later learn that December 2007 was the very month that the Great Recession began. I wrote in that column: “Even as the Wall Streeters are high-fiving and ordering up record shipments of Champagne and caviar, the American dream is on life support.”

So we had an orgy of bonuses just as the recession was taking hold and now another orgy (with taxpayers as the enablers) that is nothing short of an arrogantly pointed finger in the eye of everyone who suffered, and continues to suffer, in this downturn.

Whether P.T. Barnum actually said it or not, there is a sucker born every minute. American taxpayers might want to take a look in the mirror. If the epithet fits...

We need to make some fundamental changes in the way we do things in this country. The gamblers and con artists of the financial sector, the very same clowns who did so much to bring the economy down in the first place, are howling self-righteously over the prospect of regulations aimed at curbing the worst aspects of their excessively risky behavior and preventing them from causing yet another economic meltdown.

We should be going even further. We’ve institutionalized the idea that there are firms that are too big to fail and, therefore, “we, the people” are obliged to see that they don’t — even if that means bankrupting the national treasury and undermining the living standards of ordinary people. What sense does that make?

If some company is too big to fail, then it’s too big to exist. Break it up.

Why should the general public have to constantly worry that a misstep by the high-wire artists at Goldman Sachs (to take the most obvious example) would put the entire economy in peril? These financial acrobats get the extraordinary benefits of their outlandish risk-taking — multimillion-dollar paychecks, homes the size of castles — but the public has to be there to absorb the worst of the pain when they take a terrible fall.

Enough! Goldman Sachs is thriving while the combined rates of unemployment and underemployment are creeping toward a mind-boggling 20 percent. Two-thirds of all the income gains from the years 2002 to 2007 — two-thirds! — went to the top 1 percent of Americans.

We cannot continue transferring the nation’s wealth to those at the apex of the economic pyramid — which is what we have been doing for the past three decades or so — while hoping that someday, maybe, the benefits of that transfer will trickle down in the form of steady employment and improved living standards for the many millions of families struggling to make it from day to day.

That money is never going to trickle down. It’s a fairy tale. We’re crazy to continue believing it.

Copyright 2009 The New York Times Company