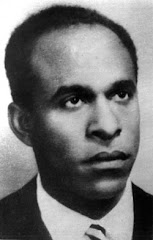

Barack Obama. The President, writes Greenwald, "In many crucial areas, has done more to subvert and weaken the left's political agenda than a GOP president could have dreamed of achieving. So potent, so overarching, are tribal loyalties in American politics that partisans will support, or at least tolerate, any and all policies their party's leader endorses – even if those policies are ones they long claimed to loathe." (Photograph: Mandel Ngan/AFP/GettyImages)

Barack Obama is Gutting the Core Principles of the Democratic Party

The president's attacks on America's social safety net are destroying the soul of the Democratic party's platform

The president's attacks on America's social safety net are destroying the soul of the Democratic party's platform

by Glenn Greenwald

July 21, 2011

The Guardian/UK

In 2005, American liberals achieved one of their most significant political victories of the last decade. It occurred with the resounding rejection of George W Bush's campaign to privatise social security.

Bush's scheme would have gutted the crux of that entitlement programme by converting it from what it has been since the 1940s – a universal guarantor of minimally decent living conditions for America's elderly – into a Wall Street casino and bonanza.

Progressive activists and bloggers relentlessly attacked both the plan and underlying premises (the myth that social security faces a "crisis"), spawning nationwide opposition. Only a few months after he unveiled his scheme to great fanfare, Bush was forced to sheepishly withdraw it, a defeat he described as his biggest failure.

That victory established an important political fact. While there are very few unifying principles for the Democratic party, one (arguably the primary one) is a steadfast defence of basic entitlement programs for the poor and elderly – social security, Medicare and Medicaid – from the wealthy, corporatised factions that have long targeted them for cuts.

But in 2009, clear signs emerged that President Obama was eager to achieve what his right-predecessor could not: cut social security. Before he was even inaugurated, Obama echoed the right's manipulative rhetorical tactic: that (along with Medicare) the programme was in crisis and producing "red ink as far as the eye can see." President-elect Obama thus vowed that these crown jewels of his party since the New Deal would be, as Politico reported, a "central part" of his efforts to reduce the deficit.

The next month, his top economic adviser, the Wall Street-friendly Larry Summers, also vowed specific benefit cuts to Time magazine. He then stacked his "deficit commission" with long-time advocates of social security cuts.

Many progressives, ebullient over the election of a Democratic president, chose to ignore these preliminary signs, unwilling to believe that their own party's leader was as devoted as he claimed to attacking the social safety net. But some were more realistic. The popular liberal blogger and economist Duncan "Atrios" Black, who was one of the leaders of the campaign against Bush's privatisation scheme, vowed in response to these early reports:

The left ... will create an epic 360-degree shitstorm if Obama and the Dems decide that cutting social security benefits is a good idea.

Fast forward to 2011: it is now beyond dispute that President Obama not only favours, but is the leading force in Washington pushing for, serious benefit cuts to both social security and Medicare.

This week, even as GOP leaders offered schemes to raise the debt ceiling with no cuts, the White House expressed support for the Senate's so-called "gang of six" plan that includes substantial cuts in those programmes.

The same Democratic president who supported the transfer of $700bn to bail out Wall Street banks, who earlier this year signed an extension of Bush's massive tax cuts for the wealthy, and who has escalated America's bankruptcy-inducing posture of Endless War, is now trying to reduce the debt by cutting benefits for America's most vulnerable – at the exact time that economic insecurity and income inequality are at all-time highs.

Where is the "epic shitstorm" from the left which Black predicted? With a few exceptions – the liberal blog FiredogLake has assembled 50,000 Obama supporters vowing to withhold re-election support if he follows through, and a few other groups have begun organising as well – it's nowhere to be found.

Therein lies one of the most enduring attributes of Obama's legacy: in many crucial areas, he has done more to subvert and weaken the left's political agenda than a GOP president could have dreamed of achieving. So potent, so overarching, are tribal loyalties in American politics that partisans will support, or at least tolerate, any and all policies their party's leader endorses – even if those policies are ones they long claimed to loathe. This dynamic has repeatedly emerged in numerous contexts. Obama has continued Bush/Cheney terrorism policies – once viciously denounced by Democrats – of indefinite detention, renditions, secret prisons by proxy, and sweeping secrecy doctrines. He has gone further than his predecessor by waging an unprecedented war on whistleblowers, seizing the power to assassinate U.S. citizens without due process far from any battlefield, massively escalating drone attacks in multiple nations, and asserting the authority to unilaterally prosecute a war (in Libya) even in defiance of a Congressional vote against authorising the war. And now he is devoting all of his presidential power to cutting the entitlement programmes that have been the defining hallmark of the Democratic party since Franklin Roosevelt's New Deal. The silence from progressive partisans is defeaning – and depressing, though sadly predictable.

The nature of American politics is that once a policy is removed from the partisan wars – once it is adopted by the leadership of both parties – it is removed from mainstream debate and fortified as bipartisan consensus. That is why false claims in the run-up to the Iraq war, endorsed by both parties, received so little mainstream journalistic scrutiny. And it's why the former Bush lawyer and right-wing ideologue Jack Goldsmith – back in May 2009 – celebrated in The New Republic the fact that Obama was doing more to strengthen Bush/Cheney terrorism policies than his former bosses could have ever achieved: by embracing the very terrorism approach he once denounced, Obama was converting it from rightwing radicalism into the official dogma of both parties, and forcing his supporters to defend what were, until 2009, the symbols of rightwing evil.

Identically, Obama is now on the verge of injecting what until recently was the politically toxic and unattainable dream of Wall Street and the American right – attacks on the nation's social safety net – into the heart and soul of the Democratic party's platform. Those progressives who are guided more by party loyalty than actual belief will seamlessly transform from virulent opponents of such cuts into their primary defenders. And thus will Obama succeed – yet again – in gutting not only core Democratic policies, but also the identity and power of the American Left.

© 2011 Guardian News and Media Limited

Glenn Greenwald was previously a constitutional law and civil rights litigator in New York. He is the author of the New York Times Bestselling book "How Would a Patriot Act?," a critique of the Bush administration's use of executive power, released in May 2006. His second book, "A Tragic Legacy", examines the Bush legacy. His next book is titled "With Liberty and Justice for Some: How the Law Is Used to Destroy Equality and Protect the Powerful."

http://www.nytimes.com/2011/07/22/opinion/22krugman.html

The Lesser Depression

July 21, 2011

By Paul Krugman

New York Times

These are interesting times — and I mean that in the worst way. Right now we’re looking at not one but two looming crises, either of which could produce a global disaster. In the United States, right-wing fanatics in Congress may block a necessary rise in the debt ceiling, potentially wreaking havoc in world financial markets. Meanwhile, if the plan just agreed to by European heads of state fails to calm markets, we could see falling dominoes all across southern Europe — which would also wreak havoc in world financial markets.

We can only hope that the politicians huddled in Washington and Brussels succeed in averting these threats. But here’s the thing: Even if we manage to avoid immediate catastrophe, the deals being struck on both sides of the Atlantic are almost guaranteed to make the broader economic slump worse.

In fact, policy makers seem determined to perpetuate what I’ve taken to calling the Lesser Depression, the prolonged era of high unemployment that began with the Great Recession of 2007-2009 and continues to this day, more than two years after the recession supposedly ended.

Let’s talk for a moment about why our economies are (still) so depressed.

The great housing bubble of the last decade, which was both an American and a European phenomenon, was accompanied by a huge rise in household debt. When the bubble burst, home construction plunged, and so did consumer spending as debt-burdened families cut back.

Everything might still have been O.K. if other major economic players had stepped up their spending, filling the gap left by the housing plunge and the consumer pullback. But nobody did. In particular, cash-rich corporations see no reason to invest that cash in the face of weak consumer demand.

Nor did governments do much to help. Some governments — those of weaker nations in Europe, and state and local governments here — were actually forced to slash spending in the face of falling revenues. And the modest efforts of stronger governments — including, yes, the Obama stimulus plan — were, at best, barely enough to offset this forced austerity.

So we have depressed economies. What are policy makers proposing to do about it? Less than nothing.

The disappearance of unemployment from elite policy discourse and its replacement by deficit panic has been truly remarkable. It’s not a response to public opinion. In a recent CBS News/New York Times poll, 53 percent of the public named the economy and jobs as the most important problem we face, while only 7 percent named the deficit. Nor is it a response to market pressure. Interest rates on U.S. debt remain near historic lows.

Yet the conversations in Washington and Brussels are all about spending cuts (and maybe tax increases, I mean revisions). That’s obviously true about the various proposals being floated to resolve the debt-ceiling crisis here. But it’s equally true in Europe.

On Thursday, the “heads of state or government of the euro area and the E.U. institutions” — that mouthful tells you, all by itself, how messy European governance has become — issued their big statement. It wasn’t reassuring.

For one thing, it’s hard to believe that the Rube Goldberg financial engineering the statement proposes can really resolve the Greek crisis, let alone the wider European crisis.

But, even if it does, then what? The statement calls for sharp deficit reductions “in all countries except those under a programme” to take place “by 2013 at the latest.” Since those countries “under a programme” are being forced into drastic fiscal austerity, this amounts to a plan to have all of Europe slash spending at the same time. And there is nothing in the European data suggesting that the private sector will be ready to take up the slack in less than two years.

For those who know their 1930s history, this is all too familiar. If either of the current debt negotiations fails, we could be about to replay 1931, the global banking collapse that made the Great Depression great. But, if the negotiations succeed, we will be set to replay the great mistake of 1937: the premature turn to fiscal contraction that derailed economic recovery and ensured that the Depression would last until World War II finally provided the boost the economy needed.

Did I mention that the European Central Bank — although not, thankfully, the Federal Reserve — seems determined to make things even worse by raising interest rates?

There’s an old quotation, attributed to various people, that always comes to mind when I look at public policy: “You do not know, my son, with how little wisdom the world is governed.” Now that lack of wisdom is on full display, as policy elites on both sides of the Atlantic bungle the response to economic trauma, ignoring all the lessons of history. And the Lesser Depression goes on.

The Lesser Depression

July 21, 2011

By Paul Krugman

New York Times

These are interesting times — and I mean that in the worst way. Right now we’re looking at not one but two looming crises, either of which could produce a global disaster. In the United States, right-wing fanatics in Congress may block a necessary rise in the debt ceiling, potentially wreaking havoc in world financial markets. Meanwhile, if the plan just agreed to by European heads of state fails to calm markets, we could see falling dominoes all across southern Europe — which would also wreak havoc in world financial markets.

We can only hope that the politicians huddled in Washington and Brussels succeed in averting these threats. But here’s the thing: Even if we manage to avoid immediate catastrophe, the deals being struck on both sides of the Atlantic are almost guaranteed to make the broader economic slump worse.

In fact, policy makers seem determined to perpetuate what I’ve taken to calling the Lesser Depression, the prolonged era of high unemployment that began with the Great Recession of 2007-2009 and continues to this day, more than two years after the recession supposedly ended.

Let’s talk for a moment about why our economies are (still) so depressed.

The great housing bubble of the last decade, which was both an American and a European phenomenon, was accompanied by a huge rise in household debt. When the bubble burst, home construction plunged, and so did consumer spending as debt-burdened families cut back.

Everything might still have been O.K. if other major economic players had stepped up their spending, filling the gap left by the housing plunge and the consumer pullback. But nobody did. In particular, cash-rich corporations see no reason to invest that cash in the face of weak consumer demand.

Nor did governments do much to help. Some governments — those of weaker nations in Europe, and state and local governments here — were actually forced to slash spending in the face of falling revenues. And the modest efforts of stronger governments — including, yes, the Obama stimulus plan — were, at best, barely enough to offset this forced austerity.

So we have depressed economies. What are policy makers proposing to do about it? Less than nothing.

The disappearance of unemployment from elite policy discourse and its replacement by deficit panic has been truly remarkable. It’s not a response to public opinion. In a recent CBS News/New York Times poll, 53 percent of the public named the economy and jobs as the most important problem we face, while only 7 percent named the deficit. Nor is it a response to market pressure. Interest rates on U.S. debt remain near historic lows.

Yet the conversations in Washington and Brussels are all about spending cuts (and maybe tax increases, I mean revisions). That’s obviously true about the various proposals being floated to resolve the debt-ceiling crisis here. But it’s equally true in Europe.

On Thursday, the “heads of state or government of the euro area and the E.U. institutions” — that mouthful tells you, all by itself, how messy European governance has become — issued their big statement. It wasn’t reassuring.

For one thing, it’s hard to believe that the Rube Goldberg financial engineering the statement proposes can really resolve the Greek crisis, let alone the wider European crisis.

But, even if it does, then what? The statement calls for sharp deficit reductions “in all countries except those under a programme” to take place “by 2013 at the latest.” Since those countries “under a programme” are being forced into drastic fiscal austerity, this amounts to a plan to have all of Europe slash spending at the same time. And there is nothing in the European data suggesting that the private sector will be ready to take up the slack in less than two years.

For those who know their 1930s history, this is all too familiar. If either of the current debt negotiations fails, we could be about to replay 1931, the global banking collapse that made the Great Depression great. But, if the negotiations succeed, we will be set to replay the great mistake of 1937: the premature turn to fiscal contraction that derailed economic recovery and ensured that the Depression would last until World War II finally provided the boost the economy needed.

Did I mention that the European Central Bank — although not, thankfully, the Federal Reserve — seems determined to make things even worse by raising interest rates?

There’s an old quotation, attributed to various people, that always comes to mind when I look at public policy: “You do not know, my son, with how little wisdom the world is governed.” Now that lack of wisdom is on full display, as policy elites on both sides of the Atlantic bungle the response to economic trauma, ignoring all the lessons of history. And the Lesser Depression goes on.