http://www.youtube.com/watch?v=gAtMEsIVLVo&feature=player_embedded#at=102

"There's no other purpose, so far as I'm concerned, for us except to reflect the times, the situations around us and the things we're able to say through our art, the things that millions of people can't say. I think that's the function of an artist and, of course, those of us who are lucky leave a legacy so that when we're dead, we also live on. That's people like Billie Holiday and I hope that I will be that lucky, but meanwhile, the function, so far as I'm concerned, is to reflect the times, whatever that might be."

"I had spent many years pursuing excellence, because that is what classical music is all about... Now it was dedicated to freedom, and that was far more important."

"Slavery has never been abolished from America's way of thinking."

All,

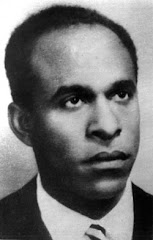

The late, GREAT Nina Simone (1933-2003) in a typically incendiary and riveting performance on German television in Berlin in 1967. This is posted in celebration of Nina's 78th birthday on Monday, February 21, 2011. I'm very happy to report that I was fortunate enough to see and hear Nina perform LIVE many times in Detroit, Chicago, New York, and Boston from 1968 on. NEEDLESS TO SAY SHE WAS ABSOLUTELY AMAZING EVERY SINGLE TIME. Check out still many more video performances below from this bona fide GIANT and Genius of the last truly 'Golden Age' of African American artists and culture (1920-1980)...ENJOY...

Kofi

The Backlash Blues

by Langston Hughes (1902-1967)

(Sung and recorded by Nina Simone, 1968)

Mister Backlash, Mister Backlash,

Just who do you think I am?

You raise my taxes, freeze my wages,

Send my son to Vietnam

You give me second class houses,

Second class schools.

Do you think that colored folks

Are just second class fools?

When I try to find a job

To earn a little cash,

All you got to offer

Is your mean ole white backlash.

But the world is big,

Big and bright and round--

And it's full of folks like me who are

Black, Yellow, Beige, and Brown.

Mister Backlash, Mister Backlash

What do you think I got to lose?

I'm gonna leave you, Mister Backlash,

Singing your mean old backlash blues.

You're the one

Will have the blues.

Not me--

Wait and see!

"There's no other purpose, so far as I'm concerned, for us except to reflect the times, the situations around us and the things we're able to say through our art, the things that millions of people can't say. I think that's the function of an artist and, of course, those of us who are lucky leave a legacy so that when we're dead, we also live on. That's people like Billie Holiday and I hope that I will be that lucky, but meanwhile, the function, so far as I'm concerned, is to reflect the times, whatever that might be."

"I had spent many years pursuing excellence, because that is what classical music is all about... Now it was dedicated to freedom, and that was far more important."

"Slavery has never been abolished from America's way of thinking."

--Nina Simone

All,

The late, GREAT Nina Simone (1933-2003) in a typically incendiary and riveting performance on German television in Berlin in 1967. This is posted in celebration of Nina's 78th birthday on Monday, February 21, 2011. I'm very happy to report that I was fortunate enough to see and hear Nina perform LIVE many times in Detroit, Chicago, New York, and Boston from 1968 on. NEEDLESS TO SAY SHE WAS ABSOLUTELY AMAZING EVERY SINGLE TIME. Check out still many more video performances below from this bona fide GIANT and Genius of the last truly 'Golden Age' of African American artists and culture (1920-1980)...ENJOY...

Kofi

The Backlash Blues

by Langston Hughes (1902-1967)

(Sung and recorded by Nina Simone, 1968)

Mister Backlash, Mister Backlash,

Just who do you think I am?

You raise my taxes, freeze my wages,

Send my son to Vietnam

You give me second class houses,

Second class schools.

Do you think that colored folks

Are just second class fools?

When I try to find a job

To earn a little cash,

All you got to offer

Is your mean ole white backlash.

But the world is big,

Big and bright and round--

And it's full of folks like me who are

Black, Yellow, Beige, and Brown.

Mister Backlash, Mister Backlash

What do you think I got to lose?

I'm gonna leave you, Mister Backlash,

Singing your mean old backlash blues.

You're the one

Will have the blues.

Not me--

Wait and see!