All,

This is a very important extended interview conducted by Katie Couric of CBS News with Charles Ferguson, director of the critically acclaimed and Oscar winning documentary 'Inside Job' which deals with the massive criminal fraud and gigantic Ponzi schemes instituted and carried out by huge "too big to fail" Wall Street investment banks and the resulting meltdown of the American financial system in September 2008 which put the U.S. on the very brink of a complete and total economic collapse before its failing mega corporate institutions were bailed out by American taxpayers to the tune of an outrageous 800 BILLION dollar ransom. Ferguson fully documents in great detail exactly how and why both the Bush and Obama administrations were and are directly responsible for essentially covering up for as well as aiding and abetting the Wall Street debacle directly via Bush and Obama Secretaries of the Treasury Hank Paulson and Timothy Geithner as well as Obama's former major economic advisor in the White House Larry Summers (who left the White House in September 2010 to return to teaching at Harvard) who was not coincidentally also Bill Clinton's Secretary of the Treasury in the mid 1990s (I know--it's a very slimy and INCESTUOUS group of in-house government 'fixers', isn't it?)...For the Katie Couric CBS interview with Ferguson watch the video below:

And for further information on how investment banks and corporations on Wall Street continue to steal our money click on this link:

http://www.youtube.com/watch?v=ffHFjlqIzKE&feature=player_embedded

Kofi

http://www.huffingtonpost.com/charles-ferguson/the-financial-crisis-and-_1_b_782927.html

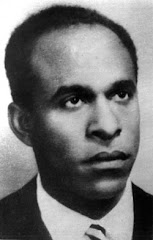

By Charles Ferguson

Director of the Wall Street documentary 'Inside Job'

Posted: November 12, 2010

Huffington Post

The Financial Crisis and America's Political Duopoly

What unites the midterm election results, the Federal Reserve's decision to spend another $600 billion to keep interest rates down, the failure to address the foreclosure crisis, and America's worsening relations with its G-20 partners? And, more generally, what explains the Obama Administration's toothless response to the financial crisis, in particular its reversion to status quo regulatory and economic policies, over the past two years?

In making my documentary on the financial crisis, Inside Job, I obsessed over these questions. Some argue that President Obama, as a matter of individual personality, is averse to confrontation; others say that, lacking financial experience while being forced to confront the most severe crisis since the Great Depression, he was hostage to his campaign advisers, who happened to be Clinton-era insiders who had helped cause the crisis. Gradually, however, I have come to a different conclusion, one based on a more fundamental, structural problem in American politics.

My answer is this: far from being in an era of brutal partisan warfare, as conventional wisdom holds and as watching the nightly television news might suggest, the United States is now in the grip of a political duopoly in which both parties are thoroughly complicit. They play a game: they agree to fight viciously over certain things to retain the allegiance of their respective bases, while agreeing not to fight about anything that seriously endangers the privileges of America's new financial elites. Whether this duopoly will endure, and what to do about it, are perhaps the most important questions facing Americans. The current arrangement all but guarantees the continuing decline of the United States as a nation, and of the welfare of the bottom 90% of its citizens.

First, consider Obama Administration policy. The Federal Reserve is keeping interest rates down, which greatly enriches the financial services industry. And while, to its rare credit, the Obama Administration has sought to repeal some of the Bush tax cuts for the wealthy, it has avoided any serious attempt to tax or control financial sector compensation, to recover any of the massive amounts taken by bankers during the bubble, to penalize or prosecute those who caused it, or to reverse the extraordinary rise in inequality that has transformed America over the last generation. The Republicans go even further in catering to the wealthy and the financial sector, but the differences are relatively minor.

The financial services industry and the most successful American multinational firms now obtain rapidly increasing fractions, often already the majority, of their investment, employees, and revenues from (a) other wealthy individuals and corporations and/or (b) outside the United States. Over the last two decades their political interests, contributions, and lobbying have gradually followed these larger trends. As a result, the political duopoly has overseen a massive disinvestment in the future of the United States and the American people, and a massive transfer of wealth from the bottom 90% of the population to the top 1%. Taxes on dividends, high incomes, capital gains, and estates have sharply declined, while tuition at public universities, hours worked per family, household debt, and government deficits have all increased.

And yet there is, obviously, real political fighting out there. Of what, therefore, do these vicious partisan fights consist? The two parties and their supporters attack each other on vague ideological grounds (big government, being a Washington insider, socialism, whatever), issues of personnel and power (holding up Obama appointments, redistricting, earmarks), or, more excitingly, with regard to social values issues dear to their bases: abortion; gay rights; don't ask - don't tell; sex education versus religion in schools; guaranteed-health-insurance-as-socialism; gun control; welfare; global warming. On these issues, each side can credibly tell its base that defeat would mean real losses. People do care about abortion and gay rights, for excellent reasons, and so many people on both sides grudgingly continue to participate in the charade.

The losers, of course, are the American people, and particularly America's younger generation. For at least the bottom half of the population, America's educational system is a disaster, with our high school graduation rate at 78 percent and declining (versus, for example, 96 percent for South Korea and over 90 percent for most developed nations); broadband infrastructure generally rated at about 20th in the world; and gradually deteriorating physical infrastructure. Quietly, as inequality has grown and the financial sector rose to political power, the wealthy in America have constructed increasingly separate, parallel, and private infrastructure systems for themselves - elite private schools and universities, gated communities, private planes, the hedge fund universe.

The political duopoly arrangement, with its emphasis on intense fighting over values issues, serves to divert attention from the financial sector's "quiet coup," to use the economist Simon Johnson's phrase, and to divide potential opposition to it. People who should be aligned in calling for fairer taxes, campaign finance reform, stricter financial regulation, better public education, and investment in America's infrastructure are instead divided by their opposing views on gun control, abortion, and gay marriage. It is a strategy that has worked remarkably well for both parties.

Even so, the American people have begun to sense that the system is rigged, and the recent election results are partially a consequence of this. Fewer people are voting, more people are registering as independents, and voters are more willing to switch parties. Of course, as long as the duopoly holds, there is very little that they can do. The big question is: can it hold?

Forming third parties and social movements in this kind of situation is difficult. The financial sector and the wealthiest 0.1% of the country have the twin advantages of great wealth and great cohesion. America's election districts, campaign finance arrangements, and voting rules discourage populist third parties whose base would be dispersed and, individually, not at all wealthy. At the same time, however, there are many precedents in American history for such a rebellion - the Progressive movement, FDR's post-Depression reforms, and more recently the nonpartisan civil rights, feminist, and environmental movements. In my personal conversations, I sense an emerging consensus based on nothing more complicated than a sense of basic honesty, fairness, and common sense, qualities which the American people still have in abundance. Let us hope that this can be translated into some organized force that can put an end to the present political cartel.

Charles Ferguson is the director the documentary Inside Job, a documentary film about the financial crisis now playing in theaters nationwide. He holds a Ph.D. in political science from MIT.

Author Note: The above is a corrected version of an earlier post. I would like to apologize to the bipartisan deficit reduction commission, and to the readers of the Huffington Post, for misrepresenting the commission's draft recommendations, which are in fact largely progressive in their tax and income effects. The error derived from relying upon an inaccurate secondary source, something I rarely do. Otherwise, the article was factually accurate and represents my views.

This is a very important extended interview conducted by Katie Couric of CBS News with Charles Ferguson, director of the critically acclaimed and Oscar winning documentary 'Inside Job' which deals with the massive criminal fraud and gigantic Ponzi schemes instituted and carried out by huge "too big to fail" Wall Street investment banks and the resulting meltdown of the American financial system in September 2008 which put the U.S. on the very brink of a complete and total economic collapse before its failing mega corporate institutions were bailed out by American taxpayers to the tune of an outrageous 800 BILLION dollar ransom. Ferguson fully documents in great detail exactly how and why both the Bush and Obama administrations were and are directly responsible for essentially covering up for as well as aiding and abetting the Wall Street debacle directly via Bush and Obama Secretaries of the Treasury Hank Paulson and Timothy Geithner as well as Obama's former major economic advisor in the White House Larry Summers (who left the White House in September 2010 to return to teaching at Harvard) who was not coincidentally also Bill Clinton's Secretary of the Treasury in the mid 1990s (I know--it's a very slimy and INCESTUOUS group of in-house government 'fixers', isn't it?)...For the Katie Couric CBS interview with Ferguson watch the video below:

And for further information on how investment banks and corporations on Wall Street continue to steal our money click on this link:

http://www.youtube.com/watch?v=ffHFjlqIzKE&feature=player_embedded

Kofi

http://www.huffingtonpost.com/charles-ferguson/the-financial-crisis-and-_1_b_782927.html

By Charles Ferguson

Director of the Wall Street documentary 'Inside Job'

Posted: November 12, 2010

Huffington Post

The Financial Crisis and America's Political Duopoly

What unites the midterm election results, the Federal Reserve's decision to spend another $600 billion to keep interest rates down, the failure to address the foreclosure crisis, and America's worsening relations with its G-20 partners? And, more generally, what explains the Obama Administration's toothless response to the financial crisis, in particular its reversion to status quo regulatory and economic policies, over the past two years?

In making my documentary on the financial crisis, Inside Job, I obsessed over these questions. Some argue that President Obama, as a matter of individual personality, is averse to confrontation; others say that, lacking financial experience while being forced to confront the most severe crisis since the Great Depression, he was hostage to his campaign advisers, who happened to be Clinton-era insiders who had helped cause the crisis. Gradually, however, I have come to a different conclusion, one based on a more fundamental, structural problem in American politics.

My answer is this: far from being in an era of brutal partisan warfare, as conventional wisdom holds and as watching the nightly television news might suggest, the United States is now in the grip of a political duopoly in which both parties are thoroughly complicit. They play a game: they agree to fight viciously over certain things to retain the allegiance of their respective bases, while agreeing not to fight about anything that seriously endangers the privileges of America's new financial elites. Whether this duopoly will endure, and what to do about it, are perhaps the most important questions facing Americans. The current arrangement all but guarantees the continuing decline of the United States as a nation, and of the welfare of the bottom 90% of its citizens.

First, consider Obama Administration policy. The Federal Reserve is keeping interest rates down, which greatly enriches the financial services industry. And while, to its rare credit, the Obama Administration has sought to repeal some of the Bush tax cuts for the wealthy, it has avoided any serious attempt to tax or control financial sector compensation, to recover any of the massive amounts taken by bankers during the bubble, to penalize or prosecute those who caused it, or to reverse the extraordinary rise in inequality that has transformed America over the last generation. The Republicans go even further in catering to the wealthy and the financial sector, but the differences are relatively minor.

The financial services industry and the most successful American multinational firms now obtain rapidly increasing fractions, often already the majority, of their investment, employees, and revenues from (a) other wealthy individuals and corporations and/or (b) outside the United States. Over the last two decades their political interests, contributions, and lobbying have gradually followed these larger trends. As a result, the political duopoly has overseen a massive disinvestment in the future of the United States and the American people, and a massive transfer of wealth from the bottom 90% of the population to the top 1%. Taxes on dividends, high incomes, capital gains, and estates have sharply declined, while tuition at public universities, hours worked per family, household debt, and government deficits have all increased.

And yet there is, obviously, real political fighting out there. Of what, therefore, do these vicious partisan fights consist? The two parties and their supporters attack each other on vague ideological grounds (big government, being a Washington insider, socialism, whatever), issues of personnel and power (holding up Obama appointments, redistricting, earmarks), or, more excitingly, with regard to social values issues dear to their bases: abortion; gay rights; don't ask - don't tell; sex education versus religion in schools; guaranteed-health-insurance-as-socialism; gun control; welfare; global warming. On these issues, each side can credibly tell its base that defeat would mean real losses. People do care about abortion and gay rights, for excellent reasons, and so many people on both sides grudgingly continue to participate in the charade.

The losers, of course, are the American people, and particularly America's younger generation. For at least the bottom half of the population, America's educational system is a disaster, with our high school graduation rate at 78 percent and declining (versus, for example, 96 percent for South Korea and over 90 percent for most developed nations); broadband infrastructure generally rated at about 20th in the world; and gradually deteriorating physical infrastructure. Quietly, as inequality has grown and the financial sector rose to political power, the wealthy in America have constructed increasingly separate, parallel, and private infrastructure systems for themselves - elite private schools and universities, gated communities, private planes, the hedge fund universe.

The political duopoly arrangement, with its emphasis on intense fighting over values issues, serves to divert attention from the financial sector's "quiet coup," to use the economist Simon Johnson's phrase, and to divide potential opposition to it. People who should be aligned in calling for fairer taxes, campaign finance reform, stricter financial regulation, better public education, and investment in America's infrastructure are instead divided by their opposing views on gun control, abortion, and gay marriage. It is a strategy that has worked remarkably well for both parties.

Even so, the American people have begun to sense that the system is rigged, and the recent election results are partially a consequence of this. Fewer people are voting, more people are registering as independents, and voters are more willing to switch parties. Of course, as long as the duopoly holds, there is very little that they can do. The big question is: can it hold?

Forming third parties and social movements in this kind of situation is difficult. The financial sector and the wealthiest 0.1% of the country have the twin advantages of great wealth and great cohesion. America's election districts, campaign finance arrangements, and voting rules discourage populist third parties whose base would be dispersed and, individually, not at all wealthy. At the same time, however, there are many precedents in American history for such a rebellion - the Progressive movement, FDR's post-Depression reforms, and more recently the nonpartisan civil rights, feminist, and environmental movements. In my personal conversations, I sense an emerging consensus based on nothing more complicated than a sense of basic honesty, fairness, and common sense, qualities which the American people still have in abundance. Let us hope that this can be translated into some organized force that can put an end to the present political cartel.

Charles Ferguson is the director the documentary Inside Job, a documentary film about the financial crisis now playing in theaters nationwide. He holds a Ph.D. in political science from MIT.

Author Note: The above is a corrected version of an earlier post. I would like to apologize to the bipartisan deficit reduction commission, and to the readers of the Huffington Post, for misrepresenting the commission's draft recommendations, which are in fact largely progressive in their tax and income effects. The error derived from relying upon an inaccurate secondary source, something I rarely do. Otherwise, the article was factually accurate and represents my views.